GST (Goods and Services Tax) is the largest indirect tax reform of India. GST is a single tax on the provide of goods and services. It is a destination based tax. GST will consider Central Excise Law, Service Tax Law, VAT, Entry Tax, Octroi, etc.

Need for GST :

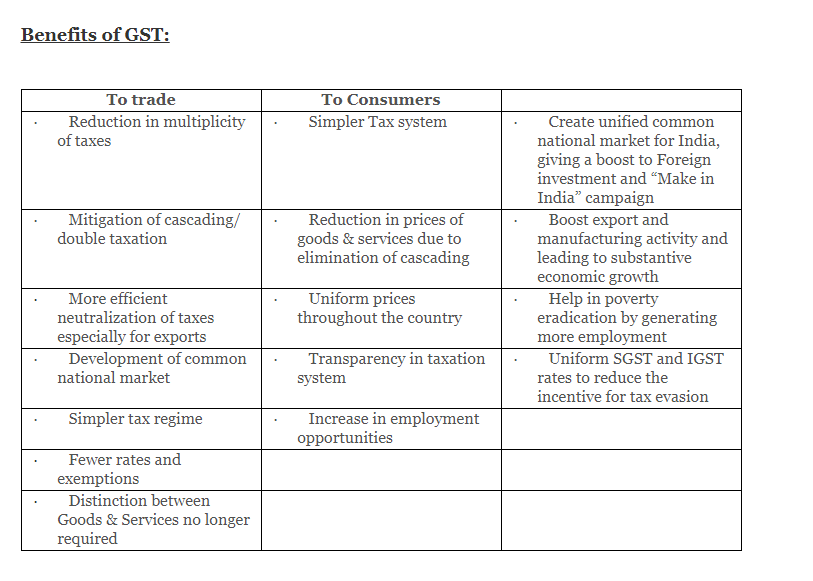

Introduction of GST is considered to be a important step in the reform of indirect taxation in India. Amalgamating of different Central and State taxes into a single tax would help mitigate the dual taxation, cascading, multiplicity of taxes, classification issues, taxable event, and etc., and leading to a common national market.

VAT rates and regulations be different from state to state. On the other hand, GST brings in uniform tax system across all the states. Here, the taxes would be divided between the Central and State government.